Update: Uber Eats Collecting Sales Tax

On July 1, 2019, Uber Eats began collecting sales tax for orders placed through the service in 14 states and the District of Columbia. The amount collected included both state and local sales taxes (if applicable), but the company has released a statement saying they were unable to separate state and local taxes for the July 1-15 reporting period and therefore, will not be submitting any taxes due.

Owners have been instructed to submit their sales taxes for July 1-15 in the usual manner. Starting with the July 16-31 reporting period, Uber will submit state sales taxes and remit any local taxes back to owners to submit. Effective with the July returns due in August, sales tax reports should be adjusted accordingly so the taxes paid by Uber are not duplicated.

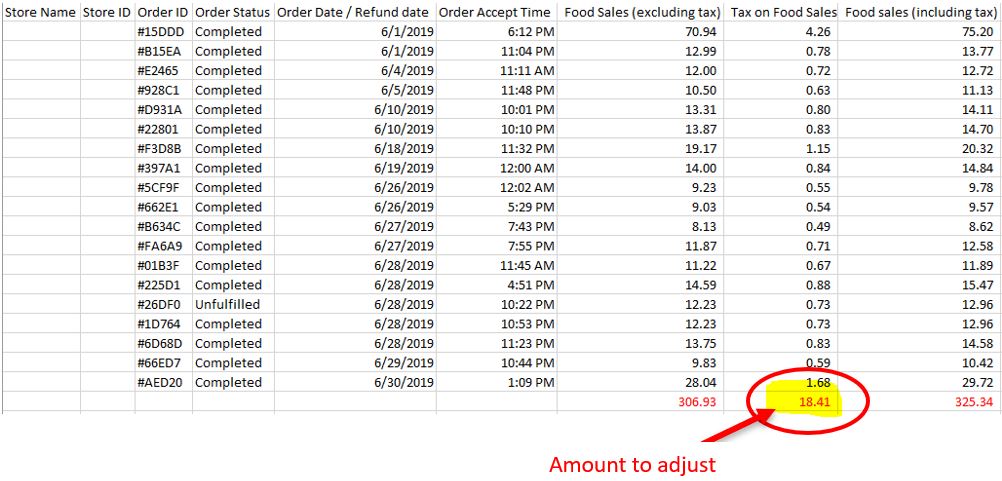

The adjustment is an easy one and can be made using your monthly Uber report as reference. Simply treat your Uber sales for the month as exempt sales for reporting purposes and not “cash out” purposes within the restaurant. Then reduce the sales tax collected on your cash sheet by the amount on the Uber report. You can calculate the local tax due by multiplying the food sales column by the local tax rate. This should be close to the amount of sales tax that Uber remits to you in the deposits.

If Mize Houser prepares your monthly sales tax reports, please know we are monitoring these changing laws and will be making the appropriate adjustments for you.

Learn more about why Uber Eats is now collecting sales tax on orders in our recent article.