What You Need to Know About Required Minimum Distributions (RMDs)

If you have a tax-advantaged retirement account, such as an IRA or 401(k), you know the importance of saving for retirement. It’s wonderful to have a nest egg out there, ready to draw on if needed, right? But your Uncle Sam gave you a tax break when you contributed that money, and eventually he wants his cut. That’s when “required minimum distributions” (RMDs) come into play.

When do RMDs need to be taken?

The rules for RMDs differ slightly depending on the type of retirement account you have, but here are the general rules:

- Your first RMD is due the year in which you attain age 73 (for 2024 and years following*)

- Your first RMD can be delayed until April 1 of the following year.

- After your first distribution, subsequent RMDs must be taken by the end of the calendar year, based on your age for that year and your retirement account balance as of December 31 of the previous year.

- That means if you wait to take your first RMD until April 1 of the following year, your second RMD is due by the end of that same calendar year.

If your retirement account is from a qualified retirement plan such as a 401(k) or profit-sharing plan and you’re still working at age 73, you can delay your RMD until the year you actually retire, unless you’re at least a 5% owner of the business sponsoring the plan.

How are RMDs calculated?

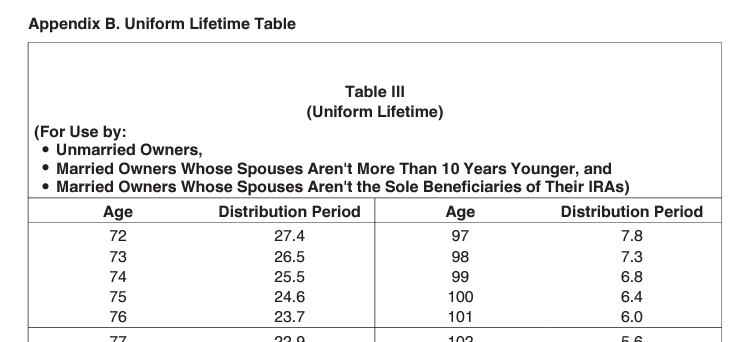

The amount of your RMD is calculated based on your retirement plan account balance as of December 31 of the previous year, divided by a factor based on your life expectancy. That factor comes from a table available in IRS Publication 590-B, and there are different tables based on your situation.**

Example:

Let’s say the balance in your traditional IRA as of December 31, 2023 was $100,000 and you will turn age 75 in 2024. You want to calculate your 2024 RMD.

If you’re single or married with a spouse not more than 10 years younger than you, you use Table III, Uniform Lifetime Table (see partial image below). At age 75, the factor used for your life expectancy is 24.6, so you divide the $100,000 balance by 24.6 to obtain your RMD amount – $4,065.04. You must take that distribution by the end of the calendar year or face a penalty.

What if I have multiple retirement accounts subject to RMDs?

If you have more than one IRA, you need to calculate your RMD from each account . . . but you can withdraw the total amount out of only one account. You don’t have to take a separate RMD from each account.

If you have more than one 401(k) account, you must calculate and withdraw RMDs separately from each plan and withdraw from that plan.

Can I withdraw more than my RMD amount?

Yes, but you can’t apply excess withdrawals to a subsequent year’s RMD.

Can I spread out taking my RMD amount throughout the year?

Yes. You can withdraw any number of distributions throughout the year as long as you’ve withdrawn your total RMD by December 31.

What’s the penalty if I don’t take my RMD, or don’t take out enough?

The tax penalty is 25% of the undistributed RMD amount. If the error is corrected within a specific timeframe, this penalty can be reduced to 10%.

Do I have to calculate my RMD each year?

That depends on the services provided by the financial institution holding your retirement accounts. According to the IRS, your IRA trustee or plan administrator must either report the amount of your RMD to you or offer to calculate it. However, you are ultimately responsible for ensuring your accurate RMD is taken.

The footnotes:

*The age at which individuals must take RMDs has been a bit of a moving target over the past few years. Until 2020, age 70.5 was the point at which RMDs needed to be taken. Then from 2020 through 2022, the RMD age moved to age 72; and beginning in 2023, became age 73. Unless the law changes, the RMD age is set to move to age 75 in 2033.

**Life expectancy tables are found in Appendix B of Publication 590. Table 1 is used by beneficiaries who inherit an IRA; Table II is for individuals whose spouses are more than 10 years younger and are the sole beneficiaries of their IRA. Individuals not in either of those situations use Table III, the Uniform Lifetime Table.

Need more information?

We’re here to help! Feel free to contact your Mize tax professional with any questions regarding your personal situation.