Protecting Your Finances in the New Year: IRS Exposes Top Tax Scams of 2023

As the year draws to a close, tax filing season is right around the corner. Before you break out your Form 1040, it’s a good idea to review the annual Dirty Dozen list of tax scams by the Internal Revenue Service (IRS). While fraudsters operate year-round, these scams often peak during the tax season. To help keep you informed, we’ve summarized the list below.

2023 Dirty Dozen Summary:

- Employee Retention Credit Claims: Scammers are aggressively promoting large refunds related to the Employee Retention Credit, attempting to deceive ineligible individuals, and collecting personal information for identity theft.

- Phishing and Smishing: Fraudulent communications posing as legitimate tax organizations, including the IRS, through unsolicited emails (phishing) or texts (smishing) aim to extract valuable personal and financial information for identity theft.

- Online Account Help Scams: Fraudsters pose as third parties offering help to create IRS Online Accounts, tricking individuals into providing personal information. Taxpayers should establish their accounts directly through IRS.gov.

- False Fuel Tax Credit Claims: Unscrupulous tax preparers encourage taxpayers to erroneously claim the fuel tax credit, intended for off-highway business and farming use.

- Fake Charities: Fraudulent charities exploit public generosity, seeking money and personal information for further exploitation through identity theft.

- Unscrupulous Tax Return Preparers: Shady tax professionals charging fees based on refund size or refusing to sign completed returns raise red flags. Taxpayers should avoid such “ghost” preparers.

- Social Media Fraud and Bad Advice: Misleading tax information circulates on social media, enticing individuals to submit false information for refunds. Taxpayers should be cautious and verify information.

- Spearphishing and Cybersecurity for Tax Professionals: Tax professionals are warned about tailored phishing attempts (spearphishing) that pose a greater threat if successful, leading to data breaches and identity theft.

- Offer in Compromise Mills: Misleading promotion of Offers in Compromise, costing taxpayers thousands of dollars. Taxpayers can check their eligibility using the IRS Offer in Compromise Pre-Qualifier tool.

- Schemes Aimed at High-Income Filers: Charitable Remainder Annuity Trusts, Monetized Installment Sales, and other schemes target high-income individuals with misleading strategies.

- Bogus Tax Avoidance Strategies: Micro-captive insurance arrangements and syndicated conservation easements are highlighted as potentially abusive practices.

- Schemes with International Elements: Offshore accounts, digital assets, Maltese individual retirement arrangements, and Puerto Rican and foreign captive insurance are scrutinized, with a reminder that the IRS can identify and track such transactions.

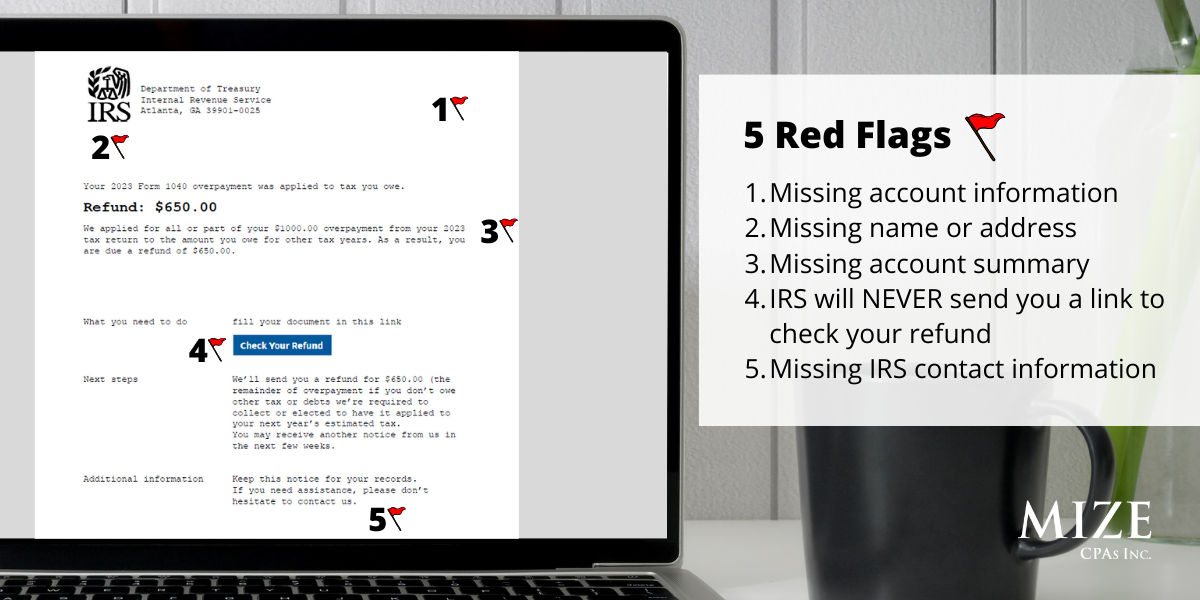

Here is an actual phishing email we received from a client. We spotted these red flags right away; would you have caught them? Or would you have clicked the link?

Protect Yourself by Watching for Red Flags

Understanding what red flags to watch for is the best line of defense against scammers. They are always trying to improve their scams to make them harder to identify, but some things are pretty constant when it comes to scams.

- Email Source Check:

When evaluating communication, especially via email, scrutinize the sender’s email address. Legitimate IRS communications typically use official irs.gov emails or are sent through traditional mail.

- Reason for Contact:

Stay cautious about unexpected communication, be it emails, texts, or calls, claiming to be from the IRS or other tax entities.

- Detecting Urgency Tactics:

Scammers often employ urgency tactics, pressuring individuals to divulge personal information hastily. Unlike scammers, the IRS avoids aggressive tactics and allows sufficient time for taxpayer responses.

- Protecting Personal Data:

Never share personal or financial information, such as Social Security numbers or bank details, through email, text, or social media. The IRS will never request such sensitive information through these channels.

- Vetting Unrealistic Offers:

Exercise caution when confronted with offers promising exceptionally large tax refunds or incentives. If an offer seems too good to be true, it likely is.

- Signing Tax Returns:

Avoid signing blank or incomplete tax returns. Reputable tax professionals ensure accurate completion and provide necessary documentation.

- Fee Transparency:

Be mindful of tax preparers charging fees based on refund size, as this can incentivize them to inflate claims or engage in fraudulent activities.

- Verification of Tax Preparers:

If a tax preparer hesitates to sign the return or provide their IRS Preparer Tax Identification Number (PTIN), consider it a significant red flag. Legitimate professionals prioritize transparency and accountability.

- Social Media Caution:

Exercise caution when encountering tax information on social media platforms, particularly if it encourages filing false or inaccurate information for a refund.

- Proofreading for Authenticity:

Scrutinize content for spelling and grammar mistakes, which can be indicative of scams. Many scammers, for whom English may not be the first language, may produce content that is difficult to read or lacks coherence.

In closing, taxpayers are urged to rely on reputable tax professionals and exercise caution when approached with offers that sound too good to be true. Remember, staying informed is the first line of defense against financial fraud.