Don’t Miss Out on The Federal Empowerment Zone Tax Credit

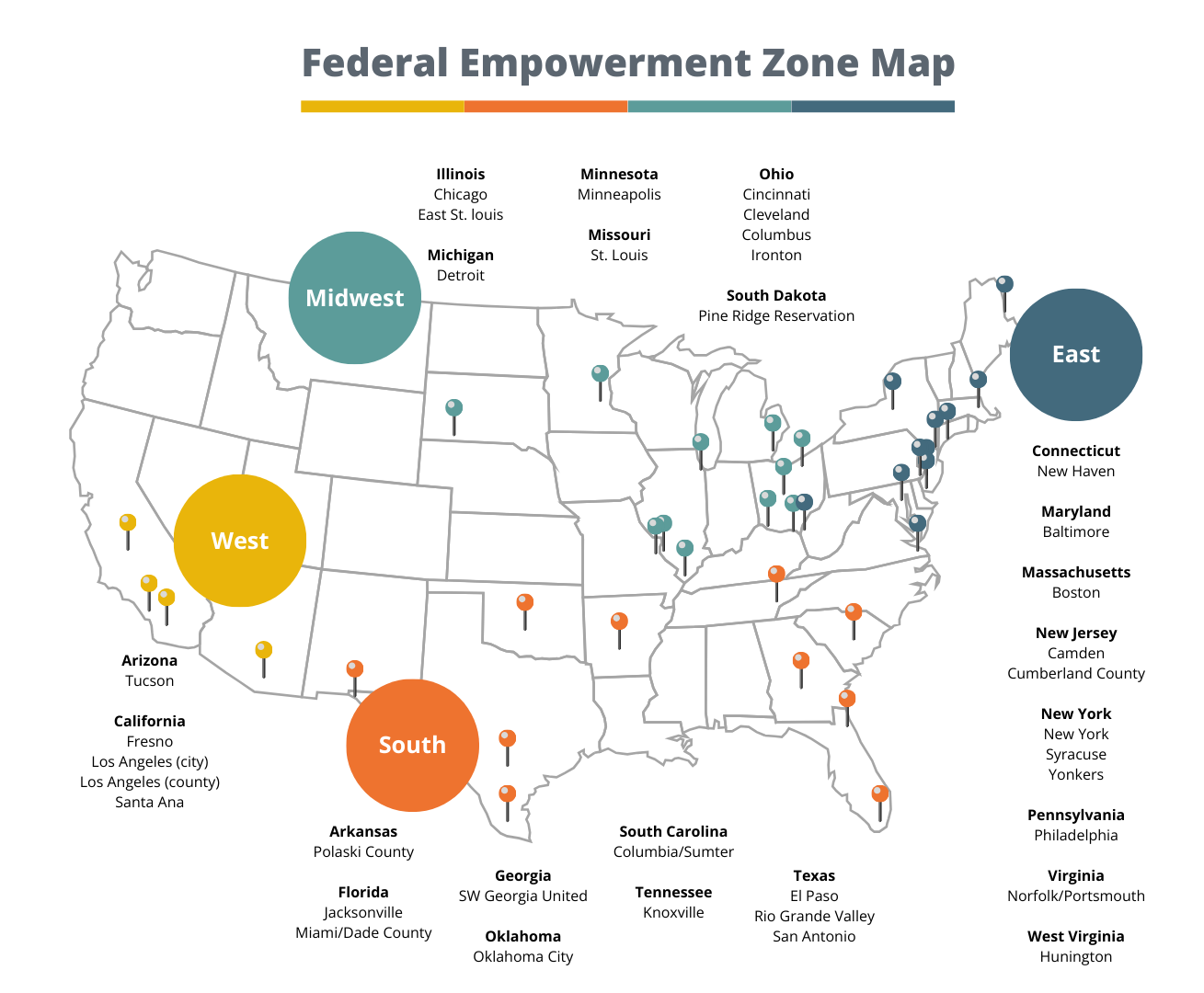

If your business operates within a Federal Empowerment Zone (FEZ) and your employees live in the same zone, you may be eligible for a valuable tax credit, but time is running out!

The IRS deadline to claim your 2024 FEZ credit is September 15.

After that, you could lose out on thousands of dollars in savings.

What’s the Opportunity?

- Up to $3,000 per qualified employee

- Available to for-profit businesses in designated FEZ areas

- Applies to full-time and part-time employees (ages 18–40)

- Must work at least 90 days in the tax year

You may be eligible to claim 20% of the first $15,000 in wages paid to each qualifying employee, but only if you act before the deadline.

Why Work with Mize CPAs?

At Mize, we make the process simple, fast, and stress-free. You have a business to run; we’ll handle the rest:

- Identify eligible employees

- Verify documentation and zone status

- Calculate your total credit potential

- Prepare IRS forms 5884, 8844, and 8845

We’re already helping business owners like you to maximize FEZ credits across the country, and we are ready to help you, too.

Get a No-Cost FEZ Credit Analysis

There’s zero obligation, just insight into what you might be missing.

Schedule your free analysis today before the September 15 deadline. Email Marc Swearengin at or fill out the form above to get started.

Don’t let your 2024 FEZ tax credit go unclaimed. Act now—before the opportunity disappears.